arkansas estate tax statute

Its a law that. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine.

Arkansas Criminal Code Annotated With Commentaries Lexisnexis Store

The amount of taxes due.

. STAR School Tax Relief Senior citizens exemption. AR K-1FE - Arkansas. Arkansas like other states has what is known as a progressive tax system in which higher income individuals pay a higher percentage of their income in taxes while those with less.

In fact only an estimated two out of every 1000 estates owe. Fiduciary and Estate Income Tax Forms 2022. Search the Arkansas Code for laws and statutes.

Specifically Amendment 74 to the Arkansas Constitution narrowly approved by voters in 1996 requires all school districts to set a minimum 25 mills property tax. Common property tax exemptions. 256 PM CDT September 28 2022.

Real Estate The Real Property Transfer Tax is levied on each deed instrument or writing by which any lands tenements or other realty sold shall be granted assigned. Thats an effective tax rate of 104. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

AR1002ES Fiduciary Estimated Tax Vouchers for 2022. A 1 All taxes levied on real estate and personal property for the county courts of this state when assembled for the purpose of levying taxes are due and payable at the county. Arkansas Estate Tax Statute.

Arkansas Code Search Laws and Statutes. People who own real estate in Arkansas are required to pay property taxes every year to the county government where the property is located. An Arkansas law that feels as old as the postal service itself-- paying your personal property tax.

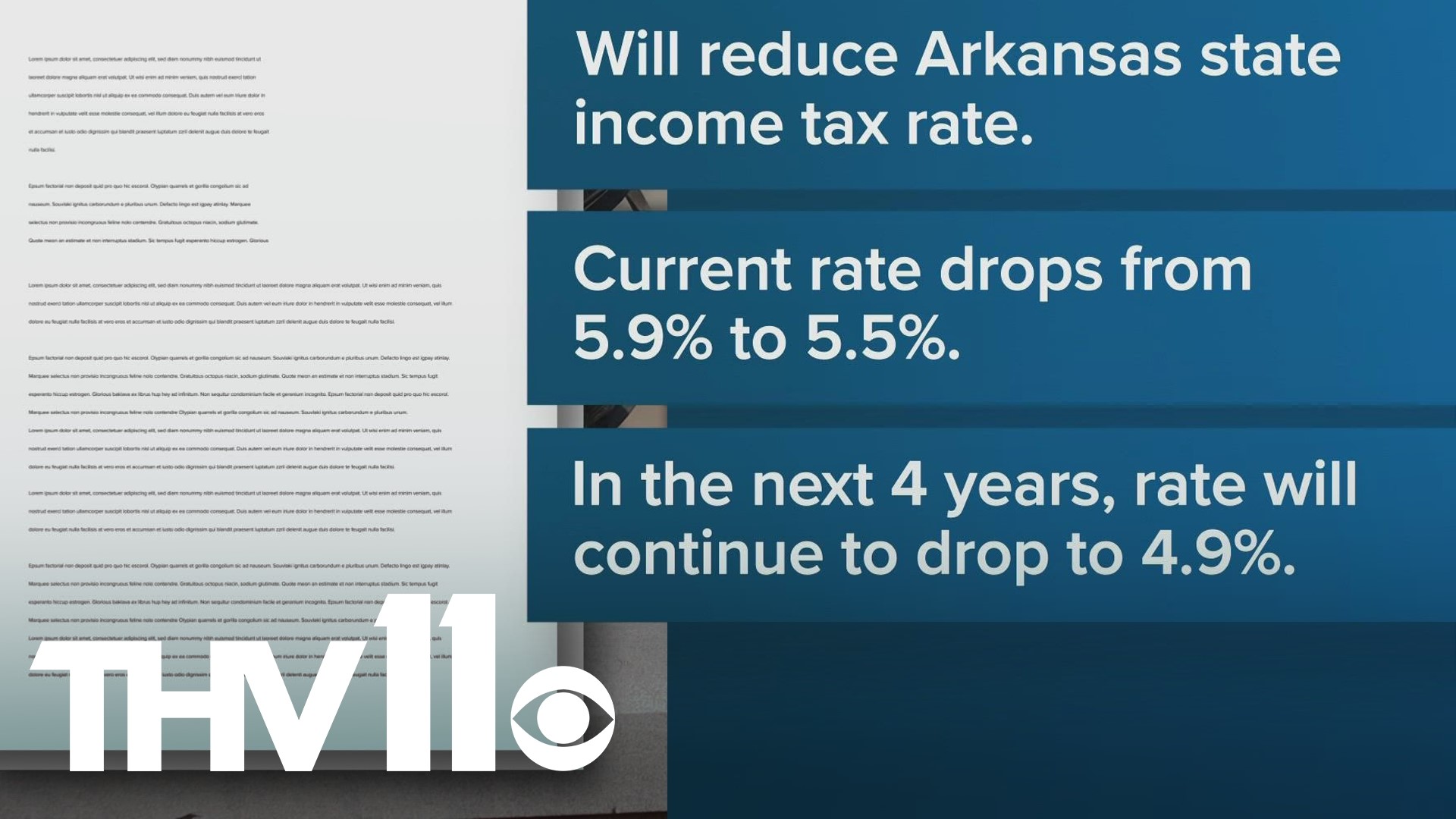

Under the new law an Arkansan with 20000 in net taxable income will pay 208 in income taxes for 2022 saving 226 compared to 2021. Exemption for persons with disabilities. Want to avoid paying a.

Online payments are available for most counties. In fact only an estimated two out of every 1000 estates owe federal estate tax.

Arkansas Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Arkansas Statutory Power Of Attorney Form Pdfsimpli

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Disabled Veterans Property Tax Exemptions By State

Arkansas Sales Tax Rate Rates Calculator Avalara

How Is Arkansas Probate Law Different

Learn More About Arkansas Property Taxes H R Block

How Do State And Local Property Taxes Work Tax Policy Center

Liens And Mortgages On Tax Deed Property The Hardin Law Firm Plc

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Transfer On Death Tax Implications Findlaw

Guide To Resolving Arkansas Back Taxes Other Tax Problems

How Your Taxes Will Change In Arkansas In 2022 Thv11 Com

7 Wacky Taxes From The Us And Abroad Turbotax Tax Tips Videos